What to Expect from the Trump 2.0 Administration on the Energy Front

We take a look at Trump's stated beliefs on the energy markets, and what he could accomplish in his second tenure as POTUS.

In two weeks from now (Monday, January 20, 2025), Donald Trump will become the 47th President of the United States. Trump’s re-election, after being the 45th President from 2017-2020 and losing the 2020 presidential election, is a feat that has happened only once before, when Democrat Grover Cleveland was the 22nd and 24th President of the United States in the late 19th century.

For those of us in the energy and energy-related sectors of the economy, the pertinent question is how the next four years (2025-2028) will differ from the Biden Administration’s approach to energy, and the increasing demand for electricity in the US.

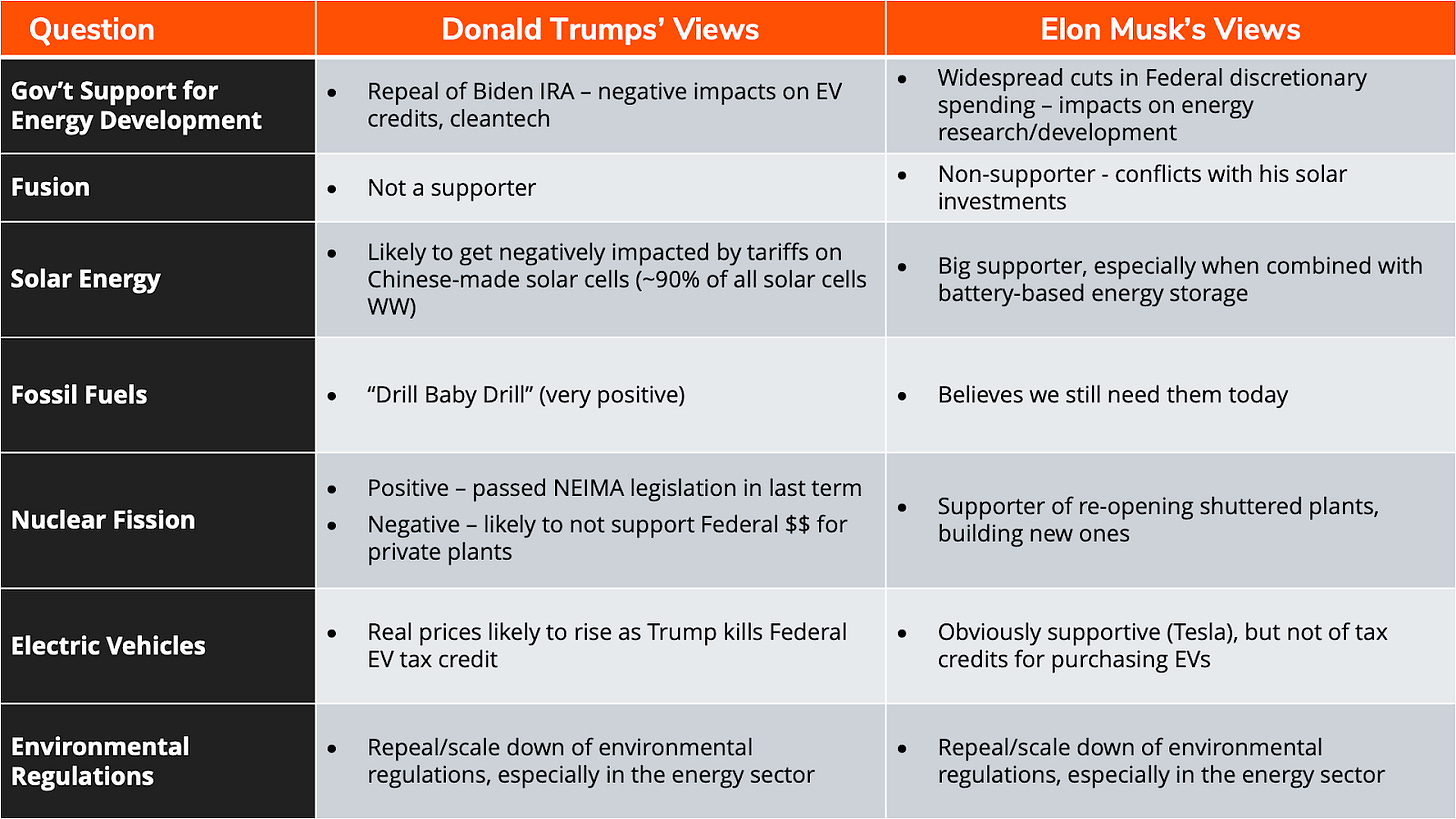

To judge this question effectively, we need to look at both Trump’s stated beliefs on the energy markets, as well as what he can likely accomplish in the next four years. Luckily for us, we have both Trump’s previous administration to look at for clues, and the fact that both Donald Trump (and his government/industry efficiency advisor Elon Musk) are anything but opaque on social media. So what do we know about each of their views on a number of energy questions:

So if we were to summarize “things to watch for” during Trump 2.0 into a few simple bullets, they would be as follows:

Impacts on Demand

Reducing/eliminating electric vehicle (EV) tax credits

The negative impact of China tariffs on lithium-ion batteries

Impacts on Electricity Production

Reducing environmental regulations on fossil fuel electricity plants, fuel exploration

Speed up permitting of new power plants, particularly nuclear ones.

Simplify re-opening of shuttered power plants (particularly nuclear ones)

Increased tariffs on imported Chinese solar panels

Let’s explore each of these things in detail, and balance stated views against what is possible – after all, the US Government (let alone the US economy) doesn’t “turn quickly”.

Electric Vehicles Sales – Some Negative Impacts in Trump 2.0

Today, electric vehicle (EV) charging is one of the fastest-growing segments of electricity consumption. In 2023, EVs consumed 7.6MWh of electricity, which was a 45% jump from 2022. This is in part spurred by the Federal EV tax credit, where consumer-purchased EVs in the US gets a Federal tax credit of $7,500. This effectively reducing the price of an EV by about 16.5%, putting them on par with gasoline-powered cars.

This tax credit, which was enacted in the Biden Administration Inflation Reduction Act (IRA), applies through 2032. Note that since this is a law, it needs to be repealed by the US Congress (Trump cannot unilaterally shut it off). It would also likely not impact EV sales until 2026.

If EV battery prices are also negatively impacted by additional China tariffs (roughly 75%-80% of lithium-ion batteries come from China), this would further negatively impact the prices of EVs. Since consumer EV sales are highly price-sensitive, the net effect would likely be a reduction in EV sales by 10%-20%.

Finally, there is discussion about relaxing Federal regulations on driverless cars, which could offset the effects of reduced consumer purchases of EVs. It is interesting to note that Tesla would likely benefit most from driverless car regulation relaxation, given Tesla’s #1 EV sales share in the US and previous work in this area. Even given all of these factors, electricity demand from EV charging is expected to continue to grow significantly, with minimal impact from ending Federal EV tax credits.

Power Plants Streamlined Permitting – Unclear Outcome in Trump 2.0

The impact of simplifying the permitting of new power plants in the US is at best cosmetic, given that Trump will only be president for four years. Today, the average time it takes to permit and build new grid-scale powerplants is as follows:

PV Solar Power Plants: A PV solar plant can be permitted and constructed in 8-18 months. However, solar power plants are seldom adjacent to existing transmission lines, and these take at least as long to permit and build as PV solar plants do. There is also growing local opposition to the location of energy storage facilities next to solar plants due to recent incidents of uncontrolled battery fires.

Natural Gas Power Plants: Natural gas plants take roughly twice as long as PV solar plants, with timelines from 18 to 36 months. While natural gas plants are generally seen as safe and certainly less polluting than coal plants or nuclear fission plants, the fuel for these plants (e.g., natural gas) is in high demand, and prices are expected to increase over the next few years, though they will likely stay lower than their recent high in 2022.

Coal Fired Power Plants: Coal-fired power plants take 3-4 years to build, which puts the completion of the earliest plants near the end of the Trump presidency. More troubling for potential plant operators is the fact that no coal power plants have been built in the US in the past 10 years; rather, nearly 40% of existing coal plants have been retired between 2010 and 2019, mainly due to the fact that natural gas plants are cheaper to build and operate. Even if the Trump administration provides new initiatives for coal plants, it is still unlikely that more will be built.

Nuclear Fission Power Plants: Nuclear fission power plants is the one area where the incoming Trump administration is most clear in supporting, and in many ways the least able to have an impact. Forgetting permitting, the construction and test time for nuclear fission plants is 7 to 8 years, well outside the timeframe of the Trump presidency. Even while small modular reactor (SMR) nuclear plants are seen easier to permit and build than full-size plants and are potentially applicable to powering datacenters and industrial uses (steel mills, etc.), no SMR has been deployed in the US as of the end of 2024.

Finally, much of the permitting and commissioning of power plants, regardless of the type, occurs at the state and local levels, which is outside of the Federal government’s jurisdiction.

Re-Opening Existing Powerplants – Too Few to Make a Difference

The problem with this concept is that there are very few recently-closed power plants that could be reopened. In the case of re-opening nuclear fission plants, there are only three that are potentially feasible: Palisades MI (will re-open in 2025); one unit of the Three Mile Island facility (no current schedule); and the Duane Arnold plant in Iowa (though its cooling towers would need to be rebuilt).

Natural gas plants are only slightly better candidates – there are only a handful that have been recently retired, and those have been retired because of end-of-life issues, or have been partially deconstructed.

Finally, only a few coal-fired plants have been retired since 2020, and only 3 GW of capacity was retired in 2024. At best, no more than 20-30 GW of capacity (less than 1% of US capacity) could be restarted.

Can China-Focused Tariffs Stimulate a New Domestic Supply Chain Under Trump 2.0 – Probably Not in An Interesting Timeframe

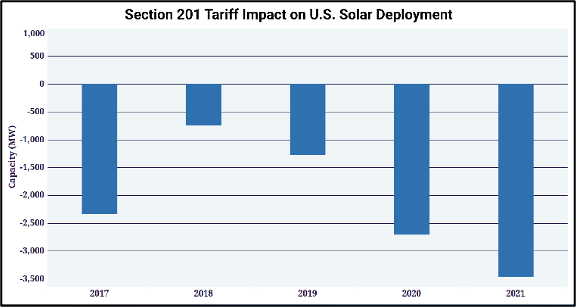

The most interesting point on this matter is that tariffs have been in place for China (Section 201) during the Biden presidency. While we still have yet to see the “takeoff” of a domestic supply chain, it is clear that these tariffs have had a significant negative impact on US solar deployments.

In any case, the biggest issue again is timeframe – it takes 12-24 months to build a solar cell plant, and roughly 2 years to build a lithium ion battery plant (assuming investment funds are available).

Summary – Impacts of Trump 2.0 Energy Policies are Most Likely Cosmetic at Best, with the Exception of EVs and (Possibly) Fusion

The biggest issue for the incoming Trump administration is that most of the energy sector takes years to respond to nearly any form of stimulus, be it tariffs, incentives, or regulator changes. Moreover, industries in these sectors tend to think of things in terms of decades. Given the clear move towards “green” power, it will be hard to get investors to think past “what happens after Trump 2.0?”

Even for EVs, moves from states such as California against internal combustion motor vehicles will likely continue the move towards EVs, even if the short-term moves negatively impact EV sales. For fusion energy, cutbacks in federal fusion funding will slow down this sector, but more investment today is coming from the private sector. Look for more of the same in the next four years that we had in the last four.