Venturing into Fusion Energy – Investing Billions to Make Trillions

The high-stakes world of fusion energy investment requires bold innovation.

During the recent webcast “Fusion Energy – A Trillion Dollar Market?,” the question was asked: Why are billionaires and venture capital firms investing in fusion now? Simply put, “They can invest billions to make trillions.” There are few opportunities for the investment community to reach the scale and return potential of fusion energy. AI is arguably the only technology representing a similar investment opportunity, with OpenAI leading the way with a projected $100B valuation. This article explores why venture capital firms invest billions into fusion startups, examining the key players, their investments, motivations, and expectations.

The Top 20 VC Investors in Fusion Energy

Here is our working of the top fusion energy investors.

Breakthrough Energy Ventures (backed by Bill Gates)

Khosla Ventures

Chrysalix Venture Capital

TDK Ventures

Hitachi Ventures

Tiger Global Management

Bezos Expeditions (Jeff Bezos)

Mithril Capital Management (Peter Thiel)

Soros Fund Management (George Soros)

Kleiner Perkins (John Doerr)

Chevron Technology Ventures

Shell Ventures

Plural Platform

UVC Partners

Delek US

Softbank

Sumitomo Corporation

Google (Alphabet)

Sony Ventures

Plug and Play Ventures

$7.1B VC Investing in Fusion Energy

The fusion energy sector has seen a dramatic increase in private investment in recent years. According to the Fusion Industry Association, private fusion companies have raised at least $7.1 billion. Significant investments may have yet to be disclosed because most companies are private entities. Here is a list of companies that we believe have raised $100M or more for their fusion systems. Some notable investments include:

Commonwealth Fusion Systems ($2B) – Raised $2 billion, with investments from Breakthrough Energy Ventures, Khosla Ventures, and others.

Helion Energy ($600M) – Raised ~$600 million, with backing from Sam Altman and others.

TAE Technologies ($250M) – Secured $250 million in a funding round led by Chevron, Google, and Sumitomo Corporation.

General Fusion ($473M) – Received investments from Jeff Bezos’ Bezos Expeditions[1].

Zap Energy – Backed by Chevron Technology Ventures and Shell for an undisclosed amount.

Tokamak Energy – Significant funding was received, though specific amounts should be disclosed in the search results.

First Light Fusion – Invested $107 million in a hyper-velocity gas gun for fusion research

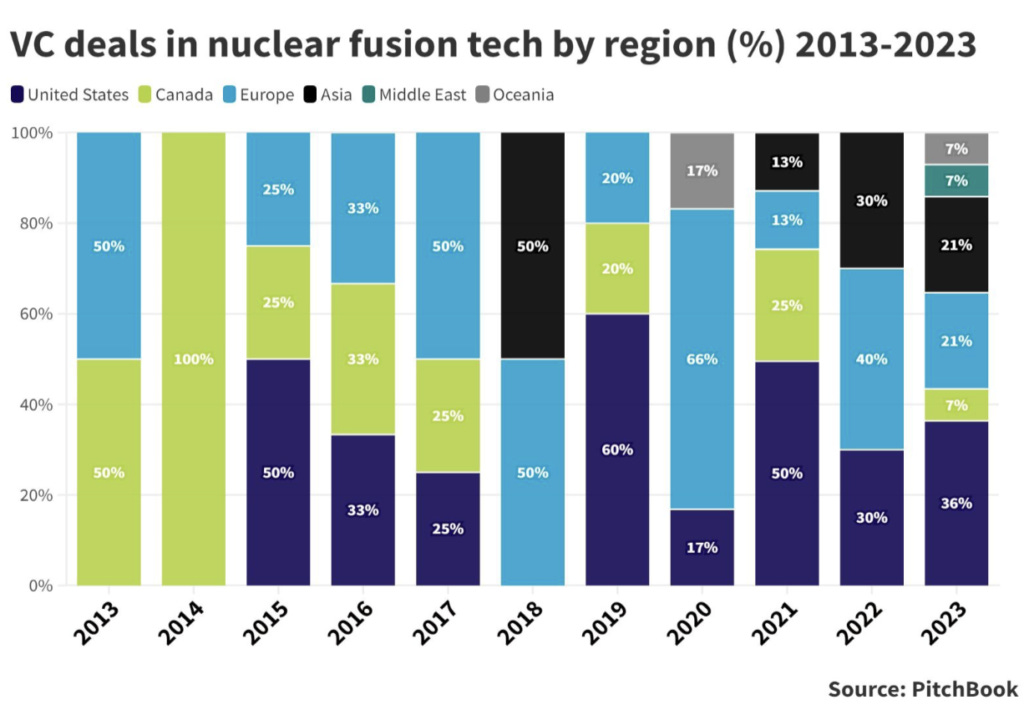

Fusion Investment is a Global Game

Fusion energy is a global game, and significant public and private investments are being made in every G20 country. China is expected to invest $1.5B this year, and the US will spend over $750M across multiple agencies. The following chart shows the international nature of VC investments.

Why Do VCs Believe in Fusion Energy? Because it Drives AI.

These billionaires are backing fusion, with billions to make trillions, because it is very closely tied to the development of AI infrastructure. They also want to be part of a technology with the potential to revolutionize the global energy landscape. Here’s why they are investing to participate in fusion energy:

Limitless Clean Energy – Fusion promises to provide virtually limitless clean energy with minimal environmental impact. Unlike fossil fuels, fusion produces no greenhouse gas emissions. And unlike current nuclear fission reactors, fusion generates minimal long-lived radioactive waste.

Addressing Climate Change – Many investors see fusion as a critical tool in combating climate change. Bill Gates has stated that fusion could be the “holy grail” for climate change mitigation. The ability to produce large amounts of carbon-free electricity could help decarbonize sectors like transportation and heavy industry.

Technological Optimism – As tech industry leaders, many of these investors are biased toward the power of innovation to solve global challenges. They see fusion as the ultimate moonshot—a challenging but potentially world-changing technology.

Economic Potential – The global energy market is worth trillions of dollars annually. If fusion can be commercialized, it represents an enormous economic opportunity. Investors hope to capture a slice of this massive market.

Legacy Building – For billionaires looking to make their mark on history, helping to develop fusion energy could be the ultimate legacy. Solving the world’s energy problems would have a profound and lasting impact on humanity.

Why Are They Investing Now?

Several factors have converged to make this a lovely time for billionaires to invest in fusion:

Technological Breakthroughs – Significant advances have been made in fusion technology in recent years. In 2022, researchers at the National Ignition Facility achieved fusion ignition for the first time, producing more energy from a fusion reaction than was put in. This milestone and progress in magnet technology and plasma control have increased confidence in fusion’s viability.

Climate Urgency – As the effects of climate change become more apparent, there’s a growing sense of urgency to develop clean energy solutions. Fusion energy has increased public and private interest as a potential game-changer.

Declining Costs —Advances in critical technologies like high-temperature superconductors and high-power lasers have helped reduce the cost of fusion research and development, making private investment more feasible.

Government Support – Increased government support for fusion research, including public-private partnerships, has created a more favorable environment for private investment.

Competitive Landscape – As more startups enter the fusion race, the technology is approaching a tipping point. Early investors hope to gain a competitive advantage.

Limitless Clean Energy – Fusion promises to provide virtually unlimited clean energy with minimal environmental impact. Unlike fossil fuels, fusion produces no greenhouse gas emissions and generates minimal long-lived radioactive waste, unlike current nuclear fission reactors.

Technological Spin-offs – Fusion research often leads to advances in related fields like materials science, plasma physics, and high-power electronics, offering additional potential for returns.

Long-term Vision – Many VC firms, particularly those backed by tech billionaires, are willing to take on moonshot projects with potentially world-changing impacts.

When Will Fusion Provide A Return On Investment?

The timeline for returns on fusion investments is more prolonged than typical VC investments, reflecting the technology’s complexity and development stage. However, many investors and companies are setting ambitious goals:

2030s Commercialization – Several companies and investors are targeting the 2030s for commercial fusion power plants. For example, Helion Energy aims to deliver fusion electricity to the grid by the early 2030s.

Mid-2020s Milestones – Some companies, like Commonwealth Fusion Systems, plan to build demonstration reactors by the mid-2020s. These could pave the way for commercial plants in the following decade.

2025-2030 Breakeven – Many fusion startups aim to achieve energy breakeven (producing more energy than consumed) between 2025 and 2030. This would be a crucial milestone for attracting further investment and moving towards commercialization.

Decadal Investment Horizon – Firms like Breakthrough Energy Ventures are setting up 20-year funds, indicating they expect significant returns within this timeframe.

Phased Returns – Some investors may see returns in phases, starting with technological spin-offs and partnerships, demonstration projects, and commercial power plants.

2040 and Beyond—More conservative estimates place the large-scale commercialization of fusion energy in the 2040s or later, particularly for approaches that require more extensive development.

It’s important to note that these timelines are ambitious and subject to technological, regulatory, and market uncertainties. The fusion energy sector has a history of delays and unforeseen challenges, which investors are factoring into their strategies.

The Fusion Conclusion

The surge in venture capital investment in fusion energy represents a significant shift in the energy landscape. Investors are betting billions on the promise of virtually limitless clean energy, driven by recent technological breakthroughs, climate urgency, and the potential for enormous returns.

While the timelines for commercialization remain ambitious and uncertain, the influx of private capital has accelerated progress in the field. The next decade will determine whether these investments will pay off, potentially revolutionizing global energy production and addressing one of humanity’s greatest challenges.

As fusion technology continues to advance, venture capitalists clearly see it not just as a scientific endeavor but as a potentially lucrative opportunity to shape the future of energy. Their willingness to invest billions with long-term horizons reflects the challenge’s scale and the magnitude of the potential rewards. These investments could turn billions into trillions while addressing critical global energy and environmental challenges.